Lately, social media company Pinterest (PINS) has been in the news, mostly for the right reasons. Founded in 2010, the company is mainly a visual search engine that helps people share ideas about their hobbies and interests.

Like any other ad-based internet business, Pinterest has also experienced its share of disruptions due to the COVID-19 pandemic. Despite this, the stock is positioned much better than most of its peers on operational, strategic, and financial fronts. Pinterest is already up YTD (year-to-date) by 114.06%, while peers such as Snap (SNAP) and Twitter (TWTR) are up 51.19% and 36.79%, respectively.

The pandemic has forced many businesses to increasingly offer a range of digital solutions. This e-commerce growth will most likely fuel a rapid increase in the share of digital advertising. The importance of social media in connecting businesses and consumers is only going to increase further. Hence, although uncertainty is ravaging the global economy today, a stable and well-funded social media business like Pinterest can prove to be a big winner in the post-pandemic world.

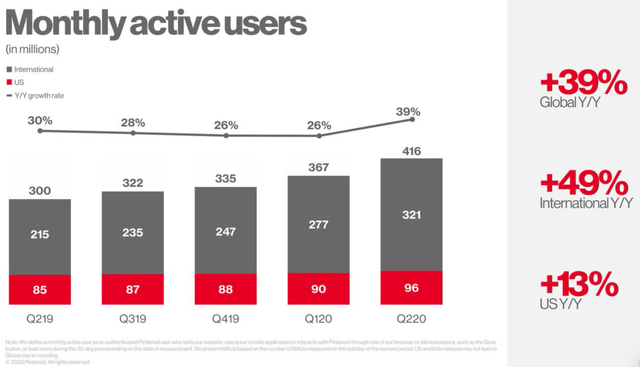

Pinterest has been growing its subscriber base at breakneck speed, especially during the pandemic

The COVID-19 pandemic has been a blessing for Pinterest, with the user base growing much faster than what was warranted by the seasonal trends. With the relaxation of shelter-in-place restrictions, the company saw a moderation in user base expansion in May 2020. However, despite this, engagement levels have remained strong both in June and July 2020.

Not only has the subscriber base expanded at a very healthy rate, but customer engagement has also been pretty high. With an MAU (monthly active user base) of 416 million, the platform has been helping its customers to tackle various COVID-related use cases.

In the U.S., a significant number of older users have returned to the platform since the start of the pandemic. But the bigger jump came from Gen Z, where people under the age of 25 years has grown faster than those over 25 years.

Now, this highly engaged and fast-growing subscriber base is an underexplored monetization opportunity.

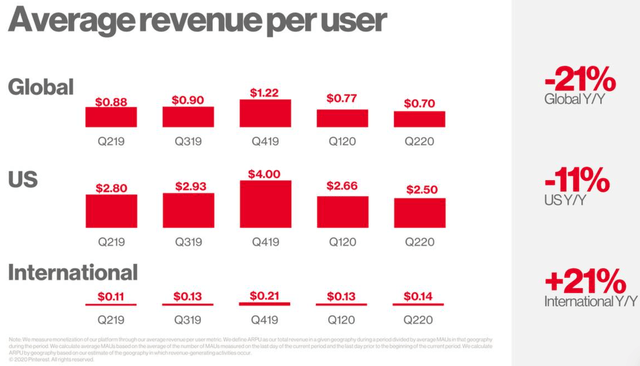

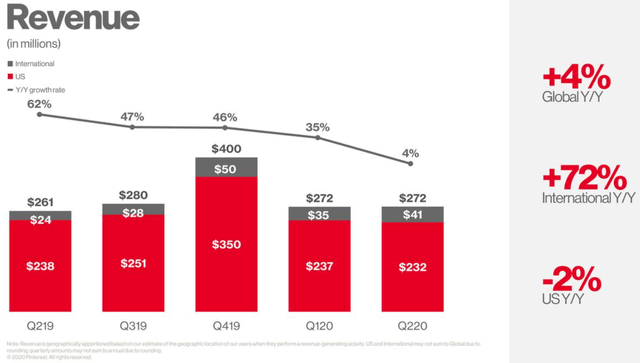

Agreed that the YoY revenue growth in the second quarter was only 4% and ARPU (average revenue per user) dropped YoY by 21%. But that was understandably an outcome of weak advertiser demand. Starting in May, Pinterest has seen demand from the CPG (consumer packaged goods) vertical on the back of robust demand for essential products.

Excluding the second-quarter performance, which has been an aberration, the company has managed to consistently grow revenues YoY, exceeding 30% since the second quarter of fiscal 2019.

There was also one major positive highlight even in the second-quarter revenue performance and that is the company’s solid revenue and ARPU growth in international markets. The company’s investments in developing direct coverage and sales support functions in English-speaking markets outside the U.S. and in Western Europe seem to be now bearing fruit.

The international business remains a major opportunity, considering that it accounted for 15% of second-quarter revenues despite making up almost 75% of the user base. Pinterest is focused on replicating all of the ad-tech tools, insights, and formats which worked in the U.S., to leverage the international market opportunity. The company has also recognized that the majority of ad-spend in Europe happens through agencies. Hence, Pinterest is working on developing tools that would help ad agencies. The company is also seeing untapped revenue opportunities in Latin America and parts of Asia-Pacific.

What differentiates Pinterest from peer Twitter is a pretty clear roadmap towards the monetization of its customer base. The company remains confident in monetizing most of its global user base in the next two years. The company has also been aggressively deploying automation tools such as automated bidding for conversion optimization and tag adoption through partners such as Shopify (NYSE:SHOP) and Google Tag Manager (NASDAQ:GOOG) (NASDAQ:GOOGL) for increased conversion visibility. These tools, coupled with effective measurement of business metrics and improved shopping experience on the platform, are expected to play a pivotal role in convincing small- and medium-sized businesses to direct their ad dollars towards Pinterest.

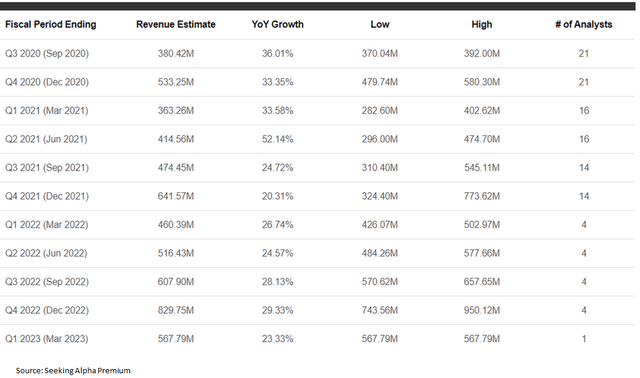

Pinterest has guided for third-quarter revenues to grow YoY (year-over-year) in the mid-30s percent range, despite assuming deceleration in growth rates starting July associated with back-to-school environment and COVID-19 uncertainties. Analysts are also estimating solid double-digit revenue growth for the company for many more years to come.

Social commerce is another major monetization opportunity for Pinterest

Pinterest has been working to reduce its complete reliance on ad spending. This strategic move could not have come at a better time. The changed consumer behavior triggered by the pandemic will be a major growth driver for social commerce. The social commerce market is expected to grow at a CAGR (compounded average growth rate) of 31.4% from $89.4 billion in 2020 to $604.5 billion in 2027.

In May, Pinterest partnered with Shopify (SHOP). This can prove to be a very lucrative collaboration, considering that the Pinterest community is known for high shopping intent, with almost 80% of the users basing their shopping decisions on pinned items.

According to the press release, “The new channel will allow U.S. and Canadian merchants to tap into this audience to seamlessly turn existing products from their store into “Product Pins” on Pinterest, as well as add a shop tab to their profile on Pinterest, for free organic promotion. Shopify merchants can also promote their pins as a paid ad, bringing customers directly into their brand’s online store for purchase.”

This partnership is expected to bring in a significant amount of purchase commissions for Pinterest, which can provide the much-needed acceleration in its ARPU in the coming quarters.

The company has a robust balance sheet and positive cash flows

Despite the very promising growth story and all the investments that are going in to monetize the ever-expanding opportunity, the company has managed to maintain a strong balance sheet. Pinterest had a cash balance of $1.7 billion and total debt of only $151 million on its balance sheet at end of June 2020. The company’s net operating cash flow was $37.80 million, while free cash flow was $146.32 million for the period from July 2019 to June 2020.

There are a few risks to consider

Although Gen Z has been seen to engage more with the Pinterest platform and explore more of its newer functionalities and services, this may not be the preferred demographic for advertisers. With a growing chunk of the subscriber base belonging to the less wealthy category, advertising rates may take some hit in the coming quarters.

Like any advertising dependent media company, Pinterest’s growth is also invariably tied to the rate of economic activity. Signs of slowing recovery can be seen, as the impact of fiscal stimulus seems to be drying up and new COVID-19 cases continue to emerge. Pinterest had been seeing a gradual improvement in ad demand from the low of April to pretty strong demand across verticals and objectives in July. However, a significant part of this demand, especially in sectors such as retail, travel, restaurants, and automotive, depends on the macroeconomic environment. Historically, retail has been a major ad-spend driver for Pinterest and the ongoing pace of retail store closures can be a major headwind for the company. While ad-spending from pure-play e-commerce and direct-to-consumer retailers has been at healthy levels, these businesses form a small part of the company’s sales mix. Hence, we see that a more prolonged economic recovery can have a detrimental impact on ad-spending and affect Pinterest’s financial performance at least in the short run.

Third-quarter earnings performance will now include a one-time payment of $89.5M, to cancel the lease on the new San Francisco space. Although a hit in the short run, this move can save the company’s annual capital spend by around $440 million.

Verdict

Pinterest is trading at a P/S (price-to-sales) multiple of 18.89x, quite above the 10.27x multiple of Twitter and somewhat more than 18.57x multiple of Snap (NYSE:SNAP). Yet, I believe that there remains upside in Pinterest based on secular tailwinds coupled with a very focused company strategy. A top-line growth over 30% is quite difficult to get at P/S multiples below 20x. Hence, Guggenheim analyst Michael Morris’ price target of $48 seems to be achievable in the next 12 months. You can check other analysts’ ratings and target prices here.

Considering the uncertainties posed by the ongoing pandemic, Pinterest seems to be a good pick for growth investors for retail investors with slightly above-average risk appetite.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.